Liste des articles

Vue 25 fois

23 mars 2018

Global trade is under serious threat. How should we respond?

Publié par

Eric Chaney

| Les Etats-Unis sous Trump

Cet article a été initialement publié sur le blog du site anglais de l'Institut Montaigne le 16 mars dernier.

The US tariff increase on steel and aluminum imports would be of minor importance if the circumstances around President Trump’s decision were not so peculiar. Europe cannot remain indifferent to this alarming situation.

- Candidate Trump had pledged to withdraw his country from multilateral agreements. But the transatlantic treaty was already dead in the water, due to mounting averseness in Europe. As to the Trans-Pacific treaty, it had not yet been implemented, and was eventually concluded without the United States. Finally, the most important treaty, NAFTA, with Canada and Mexico, is still in force, although the Trump administration is calling for its renegotiation.

- Threats of tariff increases on all Mexican, Chinese and German imports have gone unheeded.

- The candidate had promised to cancel the reform of healthcare insurance, dubbed ‘Obamacare’. The Republican Party is so divided on this issue, and the president so uninterested, that it has not occured yet. The administration is still negotiating amendments with the Congress.

- The corporate tax reform, which narrowly passed at the end of 2017, is closer to the bipartisan project once supported by the Republican leader Paul Ryan than to Trump’s original program.

It thus seemed that, alongside inflammatory tweets, the US economic and trade policy had de facto remained pragmatic. The Davos forum did raise warning signals, as Treasury Secretary Steven Mnuchin declared he saw virtues in a weak dollar, thus breaking the high-income countries’ commitment not to resort to competitive devaluation. But as the weakness of the dollar can also be explained by purely financial reasons, namely the yield curve’s flattening in the US and its steepening in the euro area, these declarations didn’t seem to cause major concerns.

The tariff increases on steel (25%) and aluminum (10%) could be part of this aggressive pragmatism. It is true that China has long been flooding the market with surplus steel production - a way to subsidize its bankrupt state-owned enterprises. Moreover, the tariff would have a negligible macroeconomic impact, with US imports of these two metals accounting for barely 0.2% of world trade.

The fact that an extremist such as Peter Navarro, who was until now marginalized within Donald Trump’s entourage, has eventually managed to have the upper hand on trade policy is triply disturbing, even more so for the world economy than for the United States.

Secondly, US trade partners run the risk of being dragged into an escalation of retaliation, nolens volens, as - and this is the essence of the prisoner's dilemma - doing nothing can only encourage one’s opponent to push his or her advantage further, being sure to reap short-term benefits. The EU has already released a list of targeted countermeasures, and China has made it clear that it will not remain passive. At a time when President Xi Jinping is flattering his people’s nationalism to strengthen his power, he cannot afford to look weak in the face of what appears to the public as an American aggression. Even if everyone is convinced that global trade is a common economic good, with the exception of the ultra-right (Bannon, Navarro, Le Pen or Salvini in Europe) and the ultra-left (Sanders, Warren, Mélenchon or Grillo in Europe ...), the logic of escalation is powerful. As a matter of fact, global trade, which had lagged to less than 2% since 2010, began to accelerate up to 4 to 5% pace by the end of 2016. A slowdown to 2% would bring us back into the deflationary world that we seem to be currently escaping from. A trade contraction would trigger a global recession, while the wounds of the previous crisis are barely healed and the firefighters, i.e. central banks, are almost short of fire extinguishers, i.e. their scope to cut rates.

Finally, the US Federal Reserve might have to confront a formidable dilemma. The powerful fiscal stimulus resulting from tax cuts and increased military spending, combined with the mechanical effect of higher import prices, can only fuel inflation in an economy that is already practically at full employment. As suggested by the new Fed chairman Jerome Powell, the rate hiking plan should be upgraded for domestic economic reasons. Failure to act would raise the suspicion that Powell is under the thumb of Trump, which would raise the risk of a loss of credibility with the markets. This is once again a prisoner's dilemma-type situation, which can lead to a recession of the American economy, and consequently, of the world economy.

Nothing is certain at this stage. As the first thirteen months of the Trump presidency have shown, Navarro may end up in disgrace at any time, which probably explains his sycophantic confession on Bloomberg on 8 March: “My function, really, as an economist is to try to provide the underlying analytics that confirm his intuition. And his intuition is always right in these matters”. The Republican majority, rather favorable to free trade, can block the presidential initiative. And, who knows, the subject could get bogged down, similarly to the health insurance counter-reform, if it ends up boring a president whose patience does not seem to be his main quality. Moreover, international trade negotiations have a bad habit of taking years, if not decades.

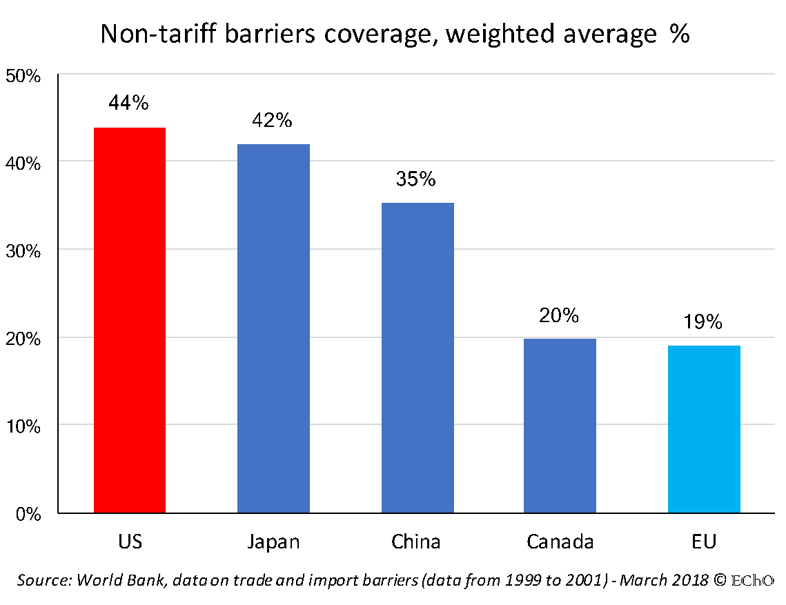

First, we must reclaim these facts that Peter Navarro likes to quote so much. Here they are, taken from the World Bank and the WTO’s data sets, and from the UN's international trade statistics:

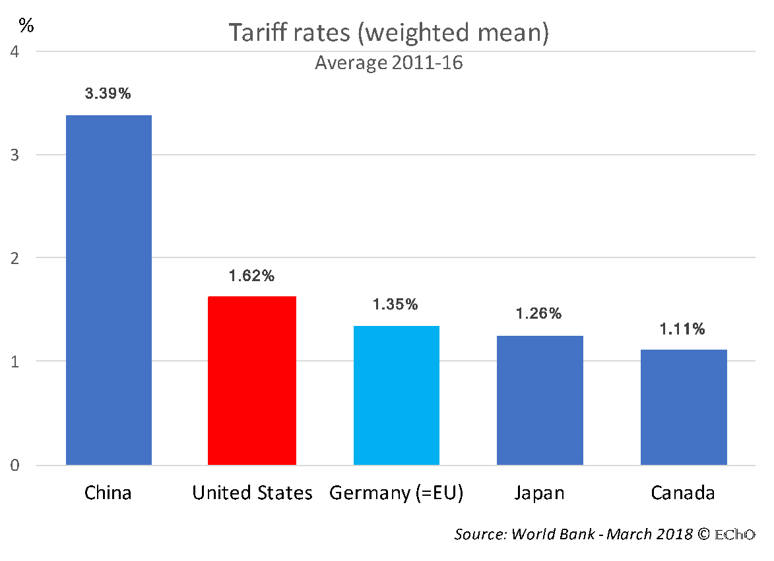

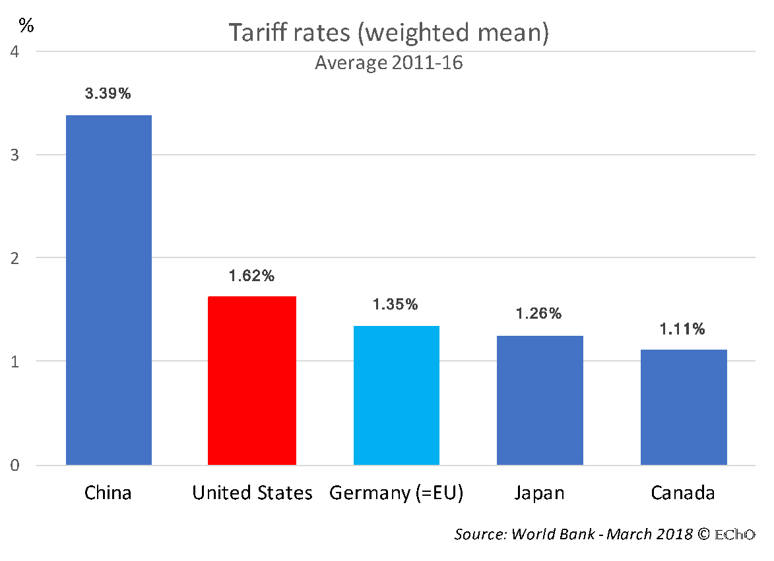

- The average tariff on imported goods in 2016 was the same in the United States and in the EU: 1.6%. Even more significant – as averages smooth the fluctuations caused by varying trade composition – the average tariff over the 2011-2016 period was equal to 1.6% in the United States, vs. 1.3% in the EU. It is therefore completely wrong to say that the EU 'treats the US badly' as far as tariffs are concerned.

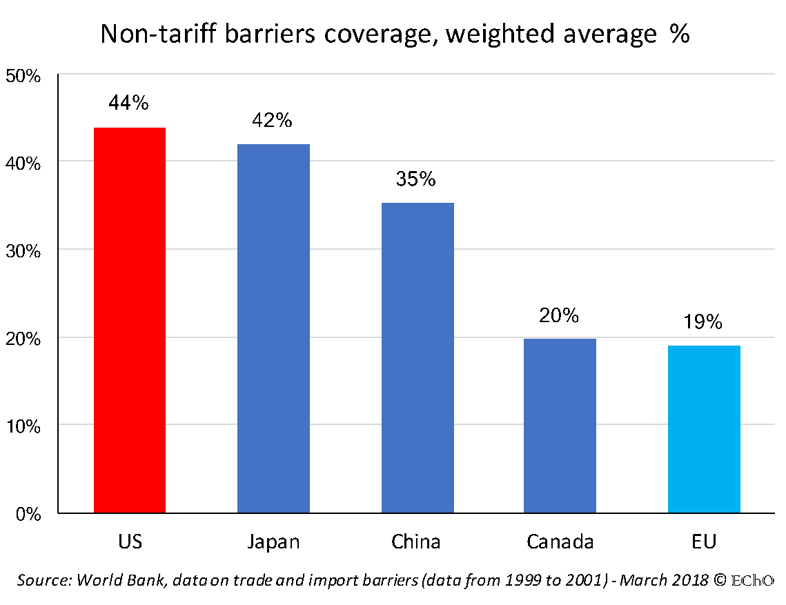

- The share of imported goods subject to non-tariff barriers was 44% in the United States, compared to 19% in the EU in 2000, the last year for which those - difficult to gather - numbers are available. The gap may have diminished since, but it certainly remains substantial and, yet again, the United States is most probably more protectionist than the EU.

Then, the EU should be prepared to respond in a measured way yet through pain, to American initiatives. The European Commission knows perfectly well how to do just that. It is indeed its role, since member states have delegated their bargaining power, including the United Kingdom, which does not seem to mind! Nothing would be worse than cacophony in this strategic game where threats play a decisive role, only if they are credible.

Finally, Europe should sweep in front of its own door. The protectionist temptation is strong in Europe, and not just within extreme political parties. Remember that Arnaud Montebourg was sincerely convinced that deindustrialization is primarily the result of 'unfair' competition, and that Nicolas Sarkozy said that for the world to go round, the French should buy cars made in France and Indians should buy cars made in India ... The protectionist temptation can only be strengthened by Trump’s policies, since protectionism can be sold as a defensive, rather than offensive, position. However, Europe has much more to lose by going down that road than, for example, China, since European institutions will obviously abide with the international law. The opposition to American protectionism, if it becomes a global risk, must thus also extend to our own protectionist demons.

The US tariff increase on steel and aluminum imports would be of minor importance if the circumstances around President Trump’s decision were not so peculiar. Europe cannot remain indifferent to this alarming situation.

Until now: an aggressive, sometimes disturbing, pragmatism

Let us first observe that the American president’s bellicose rhetoric only partly translated into actions until now. Indeed:- Candidate Trump had pledged to withdraw his country from multilateral agreements. But the transatlantic treaty was already dead in the water, due to mounting averseness in Europe. As to the Trans-Pacific treaty, it had not yet been implemented, and was eventually concluded without the United States. Finally, the most important treaty, NAFTA, with Canada and Mexico, is still in force, although the Trump administration is calling for its renegotiation.

- Threats of tariff increases on all Mexican, Chinese and German imports have gone unheeded.

- The candidate had promised to cancel the reform of healthcare insurance, dubbed ‘Obamacare’. The Republican Party is so divided on this issue, and the president so uninterested, that it has not occured yet. The administration is still negotiating amendments with the Congress.

- The corporate tax reform, which narrowly passed at the end of 2017, is closer to the bipartisan project once supported by the Republican leader Paul Ryan than to Trump’s original program.

It thus seemed that, alongside inflammatory tweets, the US economic and trade policy had de facto remained pragmatic. The Davos forum did raise warning signals, as Treasury Secretary Steven Mnuchin declared he saw virtues in a weak dollar, thus breaking the high-income countries’ commitment not to resort to competitive devaluation. But as the weakness of the dollar can also be explained by purely financial reasons, namely the yield curve’s flattening in the US and its steepening in the euro area, these declarations didn’t seem to cause major concerns.

The tariff increases on steel (25%) and aluminum (10%) could be part of this aggressive pragmatism. It is true that China has long been flooding the market with surplus steel production - a way to subsidize its bankrupt state-owned enterprises. Moreover, the tariff would have a negligible macroeconomic impact, with US imports of these two metals accounting for barely 0.2% of world trade.

A decision made by a quasi-clandestine committee

Yet this is not the case. President Trump invoked national security reasons to justify his decision, using a trade law dating back to the middle of the Cold War (1962). This means that the US administration is sweeping away any economic case based on the defense of the precious common good that is international trade. Moreover, the decision was made almost secretly by a small committee which included Peter Navarro, a trade adviser whose book Death by China had drawn the attention of then candidate Trump’s son-in-law, and for whom external trade is a zero-sum game. Gary Cohn, now former director of the National Economic Council and former chief economic adviser to the President, was bypassed. Convinced that global trade is instead a motor for US growth – iPhones and Hollywood are some telling examples – Cohn immediately resigned.The fact that an extremist such as Peter Navarro, who was until now marginalized within Donald Trump’s entourage, has eventually managed to have the upper hand on trade policy is triply disturbing, even more so for the world economy than for the United States.

Three dangers for the global economy

First, the uncertainty regarding the American strategy is becoming as thick as in the aftermath of the election. Are they seeking a dominant position ahead of future trade renegotiations, starting with NAFTA (Mexico and Canada will be the main victims of the tariff rate hike), which would open the door to compromises and to the withdrawal of the tariff once the goal of the US administration is reached? Or are we witnessing the beginning of the implementation of Navarro's protectionist program, in preparation of midterm elections and, more importantly, of the 2020 presidential election? The fact that Senator Elizabeth Warren, who represents the Democratic party’s hard Left has approved Trump’s measure on CNN could lead us to believe that this is the case. Uncertainty in itself is a negative factor for economic growth, as it increases the risk associated with any investment decision, especially among US trade counterparts.Secondly, US trade partners run the risk of being dragged into an escalation of retaliation, nolens volens, as - and this is the essence of the prisoner's dilemma - doing nothing can only encourage one’s opponent to push his or her advantage further, being sure to reap short-term benefits. The EU has already released a list of targeted countermeasures, and China has made it clear that it will not remain passive. At a time when President Xi Jinping is flattering his people’s nationalism to strengthen his power, he cannot afford to look weak in the face of what appears to the public as an American aggression. Even if everyone is convinced that global trade is a common economic good, with the exception of the ultra-right (Bannon, Navarro, Le Pen or Salvini in Europe) and the ultra-left (Sanders, Warren, Mélenchon or Grillo in Europe ...), the logic of escalation is powerful. As a matter of fact, global trade, which had lagged to less than 2% since 2010, began to accelerate up to 4 to 5% pace by the end of 2016. A slowdown to 2% would bring us back into the deflationary world that we seem to be currently escaping from. A trade contraction would trigger a global recession, while the wounds of the previous crisis are barely healed and the firefighters, i.e. central banks, are almost short of fire extinguishers, i.e. their scope to cut rates.

Finally, the US Federal Reserve might have to confront a formidable dilemma. The powerful fiscal stimulus resulting from tax cuts and increased military spending, combined with the mechanical effect of higher import prices, can only fuel inflation in an economy that is already practically at full employment. As suggested by the new Fed chairman Jerome Powell, the rate hiking plan should be upgraded for domestic economic reasons. Failure to act would raise the suspicion that Powell is under the thumb of Trump, which would raise the risk of a loss of credibility with the markets. This is once again a prisoner's dilemma-type situation, which can lead to a recession of the American economy, and consequently, of the world economy.

Nothing is certain at this stage. As the first thirteen months of the Trump presidency have shown, Navarro may end up in disgrace at any time, which probably explains his sycophantic confession on Bloomberg on 8 March: “My function, really, as an economist is to try to provide the underlying analytics that confirm his intuition. And his intuition is always right in these matters”. The Republican majority, rather favorable to free trade, can block the presidential initiative. And, who knows, the subject could get bogged down, similarly to the health insurance counter-reform, if it ends up boring a president whose patience does not seem to be his main quality. Moreover, international trade negotiations have a bad habit of taking years, if not decades.

What to do if we do not content ourselves with wishful thinking?

We can only wish to escape the cycle of trade sanctions and counter-sanctions. The collective memory of the catastrophic impact of the 1930 ultra-protectionist Smoot-Hawley trade Act, which President Hoover renounced to oppose, was so vivid that such a cycle was avoided in 2009-2010.t. Yet one cannot be content with only wishful thinking. What should Europeans do?First, we must reclaim these facts that Peter Navarro likes to quote so much. Here they are, taken from the World Bank and the WTO’s data sets, and from the UN's international trade statistics:

- The average tariff on imported goods in 2016 was the same in the United States and in the EU: 1.6%. Even more significant – as averages smooth the fluctuations caused by varying trade composition – the average tariff over the 2011-2016 period was equal to 1.6% in the United States, vs. 1.3% in the EU. It is therefore completely wrong to say that the EU 'treats the US badly' as far as tariffs are concerned.

- The share of imported goods subject to non-tariff barriers was 44% in the United States, compared to 19% in the EU in 2000, the last year for which those - difficult to gather - numbers are available. The gap may have diminished since, but it certainly remains substantial and, yet again, the United States is most probably more protectionist than the EU.

Then, the EU should be prepared to respond in a measured way yet through pain, to American initiatives. The European Commission knows perfectly well how to do just that. It is indeed its role, since member states have delegated their bargaining power, including the United Kingdom, which does not seem to mind! Nothing would be worse than cacophony in this strategic game where threats play a decisive role, only if they are credible.

Finally, Europe should sweep in front of its own door. The protectionist temptation is strong in Europe, and not just within extreme political parties. Remember that Arnaud Montebourg was sincerely convinced that deindustrialization is primarily the result of 'unfair' competition, and that Nicolas Sarkozy said that for the world to go round, the French should buy cars made in France and Indians should buy cars made in India ... The protectionist temptation can only be strengthened by Trump’s policies, since protectionism can be sold as a defensive, rather than offensive, position. However, Europe has much more to lose by going down that road than, for example, China, since European institutions will obviously abide with the international law. The opposition to American protectionism, if it becomes a global risk, must thus also extend to our own protectionist demons.

Auteur

President of EChO SAS.

Economic advisor to Institut Montaigne.

Vice Chairman of the Board of the Institut des Hautes Etudes Scientifiques.

Chief economist for the AXA Group from 2008 to 2016. Advisor to the CEO until end-2016.

Former member of the Executive Committee at AXA Investment Managers.

Before joining AXA, Chief economist for Europe at Morgan Stanley. Team ranked #1 by Institutional Investors from 1997 to 2001.

Previously, headed the economic forecasting unit of the French statistical office (INSEE) and principal editor of INSEE’s quarterly publication ‘Note de Conjonture’. Before that, responsible for global economic analysis and forecasts at the French Treasury.

Member of the Scientific Council of the Autorités des marchés financiers (French market watchdog). Former member of the Scientific Board of the AXA Research Fund. Former member of the French Economic Council of the Nation and of the French Tax Council.

Former Associate Professor at the French School of Administration (ENA).

Former professor of Mathematics and editor of a mathematical journal of the University of Strasbourg.

Graduated from the Paris Graduate School of Economics, Statistics and Finance (ENSAE ParisTech).

Live in Paris, married, five children. Voir les 4 Voir les autres publications de l’auteur(trice)

Economic advisor to Institut Montaigne.

Vice Chairman of the Board of the Institut des Hautes Etudes Scientifiques.

Chief economist for the AXA Group from 2008 to 2016. Advisor to the CEO until end-2016.

Former member of the Executive Committee at AXA Investment Managers.

Before joining AXA, Chief economist for Europe at Morgan Stanley. Team ranked #1 by Institutional Investors from 1997 to 2001.

Previously, headed the economic forecasting unit of the French statistical office (INSEE) and principal editor of INSEE’s quarterly publication ‘Note de Conjonture’. Before that, responsible for global economic analysis and forecasts at the French Treasury.

Member of the Scientific Council of the Autorités des marchés financiers (French market watchdog). Former member of the Scientific Board of the AXA Research Fund. Former member of the French Economic Council of the Nation and of the French Tax Council.

Former Associate Professor at the French School of Administration (ENA).

Former professor of Mathematics and editor of a mathematical journal of the University of Strasbourg.

Graduated from the Paris Graduate School of Economics, Statistics and Finance (ENSAE ParisTech).

Live in Paris, married, five children. Voir les 4 Voir les autres publications de l’auteur(trice)

Aucun commentaire

Vous devez être connecté pour laisser un commentaire. Connectez-vous.